Nvidia (NVDA) stock opened the year at about $50 per share, on a split-adjusted basis. As of late November 2024, the semiconductor stock’s price had eclipsed $145. The growth equates to a year-to-date value increase of almost 195%.

Nvidia (NVDA) stock opened the year at about $50 per share, on a split-adjusted basis. As of late November 2024, the semiconductor stock’s price had eclipsed $145. The growth equates to a year-to-date value increase of almost 195%. The gain is related to the rising demand for Nvidia’s high-performance chips that can power artificial intelligence workloads.

When one of the world’s largest companies nearly triples in value over 11 months, investors take notice. You might naturally wonder if Nvidia will keep growing and, if so, whether you can benefit.

To help you decide if you should invest in Nvidia, let’s review key factors from the company’s last earnings release and the questions you should consider before placing a buy order.

Nvidia’s third-quarter highlights

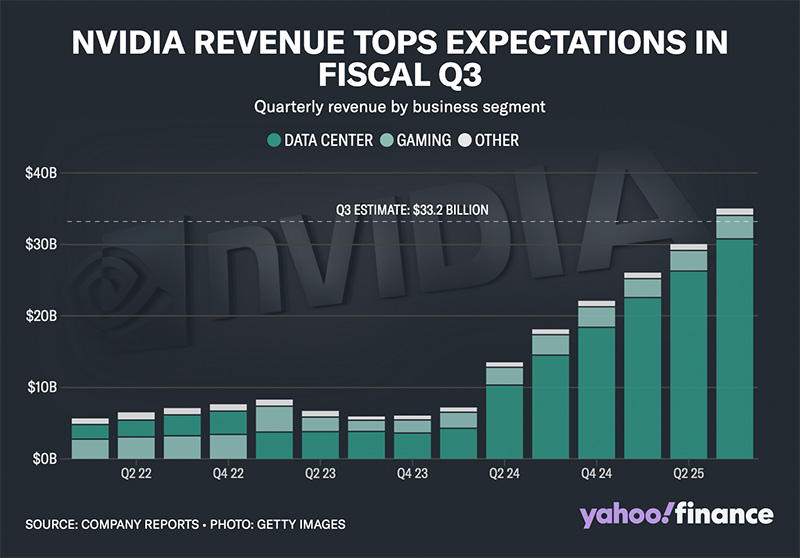

Nvidia reported $35.1 billion in revenue and $0.81 in non-GAAP diluted earnings per share (EPS) in the third quarter. Revenue had increased by 94% from the prior-year quarter, and EPS rose 103% year over year.

Learn more: Track Nvidia’s stock price here

Notably, Nvidia generated nearly 88% of its revenue from its data center reporting segment, which includes the company’s AI computing solutions. Data center revenues grew 112% year over year, outpacing the company’s other three segments. Nvidia’s gaming revenues grew 15%, professional visualization revenues were up 17%, and automotive and robotics revenues increased 72%.

Nvidia’s outlook

Nvidia first reported triple-digit data center revenue growth in the second quarter of fiscal 2024. Now that the company has lapped those gains, comparisons will be more challenging going forward. Even so, Nvidia’s leadership team expects more growth.

The company’s fourth quarter revenue guidance is $37.5 billion, plus or minus 2%. This compares to revenue of $22.1 billion in the fourth quarter of fiscal 2024. The non-GAAP gross margin expectation for the upcoming quarter is 73.5%, plus or minus 50 basis points. Nvidia has held its non-GAAP gross margin over 70% throughout this recent growth phase, since the second quarter of fiscal 2024.

Nvidia’s Blackwell launch

Nvidia plans to ship its most powerful graphics processing units, or GPUs, to date later this year. The launch is one for investors to watch. According to Nvidia, the next-generation Blackwell chips will deliver more computing power with lower energy consumption than the company’s industry-leading H100 chip.

Nvidia recently reported positive test results for the Blackwell platform. Against MLPerf Training 4.1 industry benchmarks, Blackwell delivered up to 2.2 times more performance per GPU. MLPerf benchmarks are developed by a consortium of AI leaders from multiple disciplines to evaluate workloads for machine-learning workflows.

If Blackwell chips live up to expectations, it could spark another wave of strong AI hardware demand.

News cited from [Yahoo Finance] – reported by Catherine Brock.