Tickmill is a global forex broker established in the United Kingdom in 2014, offering the ability to trade CFDs on currencies, stock, commodities, indices, bonds, options, metals & more.

FX Trust Score Index - Tickmill

Tickmill gained an overall score of 80.75% across our five different ratings criteria.

Tickmill Pros and Cons

- Licensed & Regulated

- Ultra-fast order execution speeds

- No withdrawal or inactivity fees

- Extensive educational resources

- Wide range of advanced trader tools

- Not available to US-based clients

*All trading involves risk. It is possible to lose all your capital.

Tickmill at a Glance

-

Tickmill Overview

-

Client Support

| Overview | |

| Year Established | 2014 |

| Licences Held | CySEC (Cyprus), FCA (UK), FSA (Seychelles), FSCA (South Africa), DFSA (UAE) |

| Demo Account Available | Yes |

| Base Currencies | EUR, GBP, USD, PLN, CHF |

| Promotions | Yes |

| Account Opening Time | Less than 5 minutes |

| Withdrawal Fee | None |

| Inactivity Fee | None, but accounts may be closed after 12 months of inactivity |

| Minimum Deposit | $100 |

| Minimum Position Size | 0.01 lot |

| Maximum Leverage | Up to 1:30 |

| Spread Type (Fixed/Variable) | Variable; Pro account from 0.0 pips, Classic account from 1.6 pips |

| Average Spread (based on EUR/USD) | 0.1 pips |

| Available Assets | Forex, Stocks, Cryptocurrencies, Commodities, Bonds, Stock Indices |

| Number of Currency Pairs | 60+ |

| Account Types | Classic, Raw, VIP |

| Mobile Trading | Yes |

| 24/7 or 24/5 Trading | 24/5 (24/7 for Cryptocurrencies) |

| Hedging Allowed | Yes |

| Scalping Allowed | Yes |

| Swap Free Account | Yes, available for Islamic Accounts |

| Languages | 15 |

| Affiliate Program | Yes |

| Free Educational Resources | Yes |

| Daily Technical Analysis | Yes |

| Platforms | Mobile App, WebTrader, MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Payment Methods | |

| Deposit methods | Credit/Debit Cards, eWallets, Bank Transfer, Skrill, Neteller, STICPAY, Przelewy24, FasaPay, UnionPay, WebMoney, and more |

| Withdrawal Methods | Credit/Debit Cards, eWallets, Bank Transfer, Skrill, Neteller, STICPAY, Przelewy24, FasaPay, UnionPay, WebMoney, and more |

| Withdrawal times | Between 1-8 minutes, depending on the payment method |

| Withdrawal limits | None specified |

| Currencies | Multiple currencies supported, including EUR, GBP, USD, PLN, CHF |

| Live Chat | Live Chat, Phone, Email, 24/5 Multilingual Support, Chatbot available |

| Contact Info | Support email: support@tickmill.com Telephone (Malaysia): +60 16 299 9449 Telephone (South Africa): +852 5808 7849 Website: www.tickmill.com |

| Social Media Channels | X (Twitter), Facebook, YouTube, Instagram, LinkedIn |

*All trading involves risk. It is possible to lose all your capital.

Is Tickmill a Trusted Forex Broker?

In this comprehensive review, we will delve deeper into Tickmill, evaluating the trustworthiness of the broker by examining a range of different factors, including fund safety, fees, educational features, promotions, online reputation and more. Tickmill is a trusted market leader, recognised by traders of all experience levels due to its strong presence in multiple regions across the globe. That said, it is important to remember that, before opening a trading account with any broker, you should take care to conduct sufficient research prior to making your final decision.

Introduction to Tickmill: A Brief Overview

Tickmill, established in 2014, is a world renowned global online trading platform offering CFD and Forex trading services. This regulated, multi-asset broker stands out for its competitive, low-cost trading conditions, offering clients access to the global markets with tight spreads and high leverage on a wide range of financial instruments.

The award-winning CFD broker is recognised in the industry for its swift order execution, transparent trading environment, and top-tier customer service, catering to both novice and experienced traders worldwide. With a strong regulatory framework and a commitment to security, Tickmill ensures a safe and reliable trading experience for all its clients.

Is Tickmill Safe?

Licensing and Regulation

Tickmill stands out in the forex and CFD brokerage landscape due to its stringent adherence to regulatory standards and licenses across multiple jurisdictions. The broker is regulated by some of the world’s most respected financial authorities, including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). This trifecta of regulatory oversight ensures that Tickmill operates under strict guidelines aimed at providing transparency, client protection, and market integrity. The regulatory framework mandates Tickmill to maintain high standards of corporate governance, financial reporting, and client fund security, which significantly enhances its credibility and reliability as a broker in the competitive trading landscape.

Security of Funds and Protection

Tickmill prioritizes the security of client funds through various protective measures, reassuring traders of the safety of their capital. Key practices include the segregation of client funds from the company’s operational funds, which is a crucial feature that protects clients’ investments from being used for any other corporate activities. Additionally, Tickmill adheres to investor compensation schemes like the FSCS under the FCA regulation, offering further financial protection to its clients. The use of SSL encryption technology for data transmission ensures that personal and transactional information remains secure, safeguarding against potential cyber threats. These security measures reflect Tickmill’s commitment to maintaining a secure trading environment for its clients.

Tickmill Trading Platforms

Tickmill provides its clients with access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, in addition to its proprietary Tickmill Web Trader platform. The MT4 and MT5 platforms are renowned for their robust functionality, including advanced charting tools, numerous technical indicators, and the ability to use automated trading systems. The Tickmill Web Trader offers a convenient, no-download trading experience, accessible directly from a web browser, complementing the more comprehensive desktop applications. Additionally, Tickmill’s mobile trading options ensure that traders can manage their accounts and execute trades while on the move, with apps available for both iOS and Android devices. This range of platforms caters to the needs of both novice and experienced traders, providing a versatile trading environment.

Tickmill Account Types

The broker offers two main account types, called Classic and Raw. Both accounts require a $100 minimum deposit, several available base currencies, and leverage up to 1:500. There is also an option to apply for a swap-free, or Islamic, account – for those traders that are eligible. Tighter spreads are a key feature of the Raw account, while there are no commissions on the Classic account. For a helpful comparison of the Tickmill account types, check the table below.

|

Account Type → Feature ↓ |

Classic |

Raw |

||

|

Minimum Deposit |

$100 |

$100 |

||

|

EUR/USD Spreads |

From 1.6 pips |

From 0.0 pips |

||

|

Leverage |

Up to 1:500 |

Up to 1:500 |

||

|

Margin Call |

100% |

100% |

||

|

Stop Out |

30% |

30% |

||

|

Base Currencies |

USD, EUR, GBP, PLN, CHF |

USD, EUR, GBP, PLN, CHF |

||

|

Minimum Position Size |

0.01 lot |

0.01 lot |

Tickmill’s Trading Assets

Tickmill offers a diverse range of trading assets, including forex pairs, indices, commodities, and CFDs on bonds. This selection enables traders to diversify their portfolios and take advantage of various market conditions. The forex market offerings include major, minor, and exotic currency pairs, providing ample opportunities for currency trading. Indices, commodities, and bond CFDs further expand the possibilities, allowing traders to speculate on the price movements of global markets and commodities like gold and oil. The variety of trading assets available at Tickmill is a testament to the broker’s commitment to meeting the trading needs and preferences of its clientele.

Trading Conditions at Tickmill

Spreads and Commissions

Tickmill is known for its competitive spreads and low commission structure, making it an attractive option for traders looking to minimize trading costs. The broker offers tight spreads starting from 0.0 pips on major currency pairs for its VIP account holders, which is among the most competitive in the industry. The commission rates are transparent and favorable, particularly for high-volume traders who can benefit from even lower costs. Tickmill’s pricing structure is designed to accommodate traders of all levels, from beginners to professionals, emphasising the broker’s dedication to fair and accessible trading conditions.

Leverage

Tickmill offers leverage options that cater to different trading strategies and risk appetites. The maximum leverage available varies depending on the regulatory jurisdiction and the type of financial instrument being traded. Under FCA and CySEC regulations, leverage is capped at lower levels to comply with European regulations, while the Seychelles-regulated entity offers higher leverage options. This flexibility in leverage allows traders to choose the level that best suits their trading style and risk management practices, providing an opportunity to potentially increase their trading profits.

Tickmill’s Customer Support

Tickmill prides itself on its customer support, offering multilingual assistance 24/5 via live chat, email, and phone. The support team is known for its professionalism, responsiveness, and thoroughness in addressing client queries and issues. This high level of customer service enhances the trading experience at Tickmill, ensuring that traders have the support they need whenever they encounter challenges or have questions about their accounts or trading platforms.

Educational Resources for Tickmill Traders

Tickmill is recognized for its comprehensive educational offerings, providing clients with a wide array of resources, including webinars, workshops, e-books, and instructional videos. These materials span from the basics of trading to more advanced strategies, catering to both newcomers and experienced traders. The broker’s dedication to education highlights its commitment to supporting clients’ development, ensuring they have the tools and knowledge necessary to navigate the financial markets effectively. This approach not only enriches the trading experience but also underlines Tickmill’s role as a supportive partner in its clients’ trading journeys.

Tickmill’s Reputation: What Traders are Saying

Tickmill enjoys a positive online reputation, with many traders praising the broker for its transparent trading conditions, competitive spreads, and responsive customer service. In online forums and review sites, users frequently highlight the ease of fund withdrawals and the reliability of the trading platforms offered. While no broker is without criticism, Tickmill appears to address concerns and feedback proactively, contributing to a loyal user base. The constructive feedback found online often revolves around requests for even more diverse asset classes and enhancements to mobile trading functionalities, indicating a high level of engagement from its trading community.

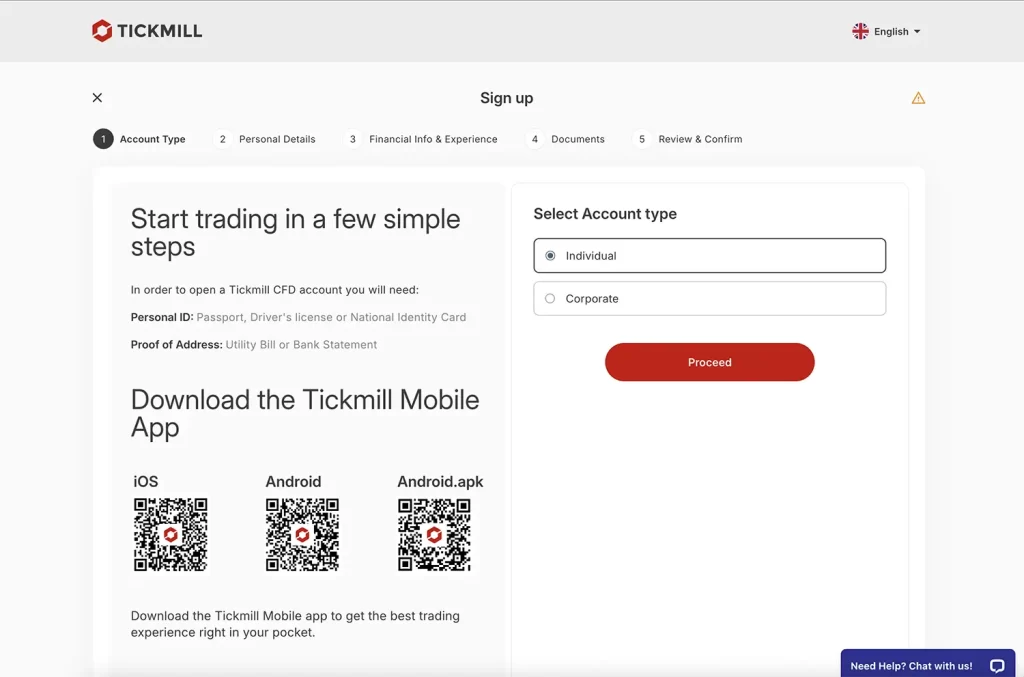

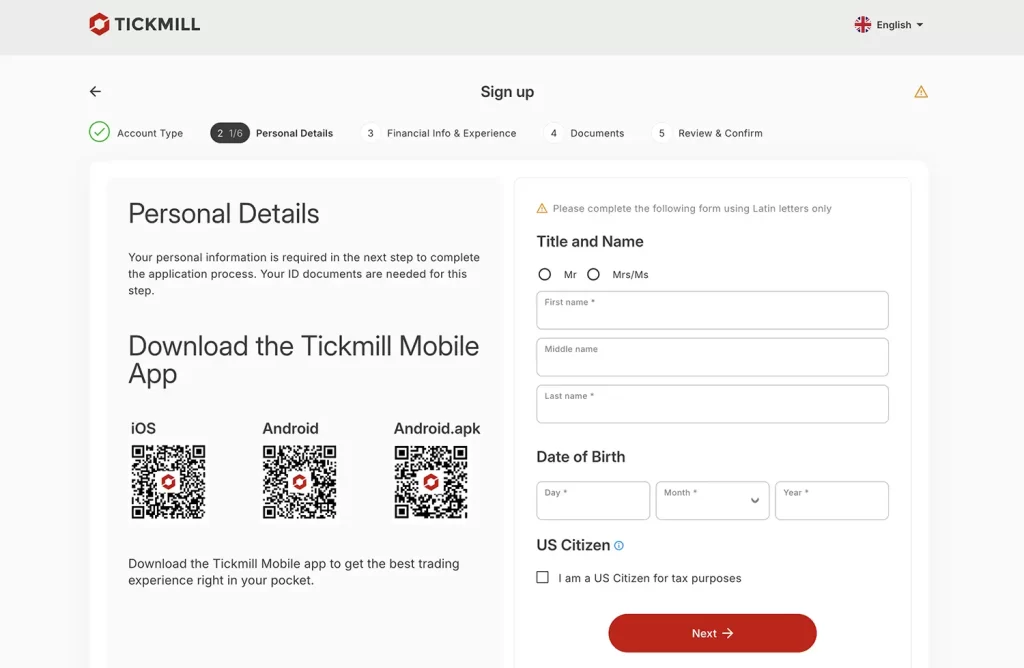

How to Open an Account

Open an account with Tickmill by following these simple steps:

- Visit the Tickmill homepage and click the Create Account Button.

- Fill in your details and keep clicking Next until you have provided all the required information and documents.

- Review and Confirm and click Register to complete.

- Your account will be created and once reviewed by Tickmill (typically within a day) you may access the Tickmill client area, create your Demo and Live Trading Accounts, deposit and start trading.

Featured Promotions

Tickmill are currently running several exciting promotions for traders to take advantage of, including a $30 Welcome Account, ‘Trader of the Month’ contest and the ‘Tickmill’s NFP Machine’ promotional campaign.

- $30 Welcome Account: New traders are offered the chance to start trading with a $30 bonus, with no deposit required in order to claim the rewards. It presents a great opportunity for newcomers to test strategies and explore financial markets without any initial investment.

- Trader of the Month: Traders are rewarded with a monetary prize at the end of every month for their exceptional skills and trading results, with the winner determined by a combination of factors such as profit, risk management, and consistency. This contest is open to all Tickmill clients.

- Tickmill’s NFP Machine: Traders predict the Non-Farm Payroll figure, with the closest guess winning a prize, making this an unusual yet innovative way to encourage traders to keep updated with the latest economic events, with the most accurate traders being rewarded in the process.

The FXTS Verdict: Is Tickmill a Trusted Broker?

Tickmill stands out from the crowd as a highly reputable and trusted forex and CFD broker in the global financial markets. Its commitment to regulatory compliance across multiple jurisdictions lays a solid foundation for trust and security. The broker’s emphasis on client fund protection, competitive trading conditions, and a wide range of trading platforms and assets cater to the diverse needs of traders. Moreover, Tickmill’s dedication to customer support, comprehensive educational resources, and positive online reputation further solidify its standing as a top choice for traders seeking a reliable broker.

*All trading involves risk. It is possible to lose all your capital.

FAQs

Tickmill is a global provider of online trading services, offering access to a wide range of financial markets including forex, stock indices, commodities, and more. It caters to both retail and institutional clients from over 200 countries, emphasizing low spreads, fast execution, and a transparent trading environment. Tickmill is regulated by several financial authorities, ensuring a secure and reliable trading experience.

Yes. Tickmill is regulated by multiple regulatory bodies worldwide, including the Seychelles Financial Services Authority (FSA), the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and others, ensuring a secure trading environment.

Tickmill provides the popular MetaTrader 4 and MetaTrader 5 platforms, available for desktop, web, and mobile devices, catering to traders’ diverse needs with advanced tools and features.

To open an account with Tickmill, potential traders must complete an online application on Tickmill’s website, providing personal information and documents for verification purposes to comply with regulatory requirements.

Tickmill is known for its competitive fees and low spreads, starting from 0.0 pips on major currency pairs. They offer different account types, including Classic, Pro, and VIP, each with specific benefits tailored to various trading strategies and volumes.