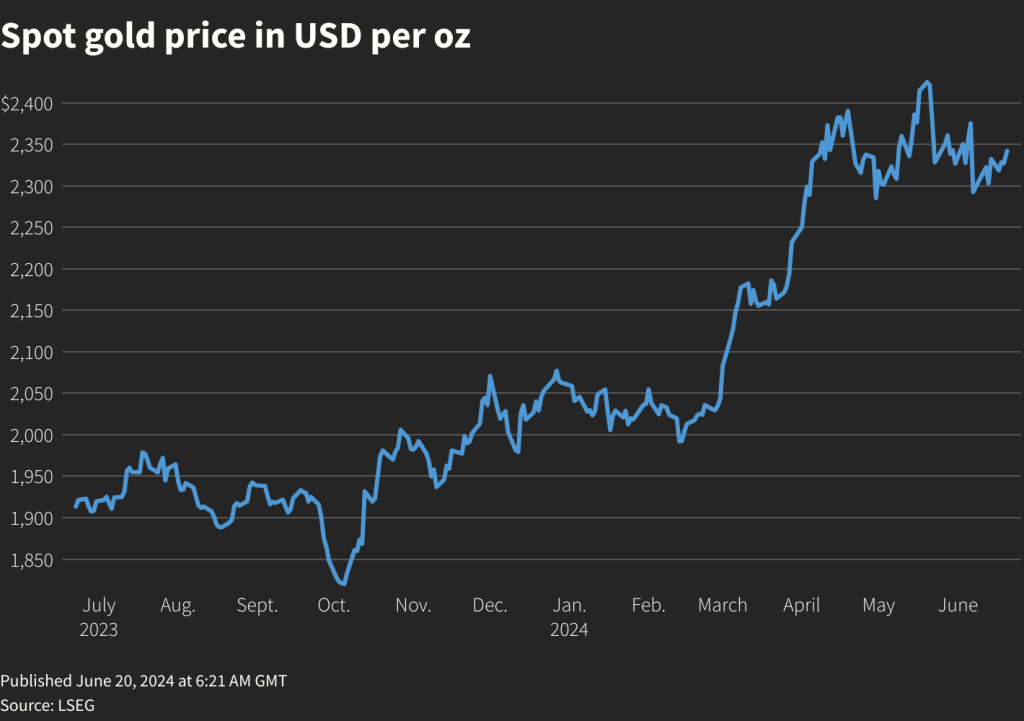

Gold prices hit a two-week high on Thursday after recent weak U.S. economic data raised market expectations of interest rate cuts from the Federal Reserve later this year.

(20th June 2024) Gold prices hit a two-week high on Thursday after recent weak U.S. economic data raised market expectations of interest rate cuts from the Federal Reserve later this year, while uncertainty around multiple elections globally also lent support.

Spot gold was up 0.5% at $2,340.12 per ounce as of 1137 GMT, after hitting its highest since June 7 earlier in the session. U.S. gold futures rose 0.3% to $2,353.70.

“Gold remains primarily driven by market expectations surrounding the Fed’s policy pivot. It may well remain rangebound for a while, until U.S. economic data can pave the way for lower interest rates and trigger the next leg up for gold,” Han Tan, chief market analyst at Exinity Group, said.

The Fed is looking for further confirmation that inflation is cooling as it steers cautiously towards what most expect to be a rate cut or two by the end of this year.

Lower interest rates reduce the opportunity cost of holding non-yielding bullion.

Additionally, gold was buoyed by safe-haven bids on persistent geopolitical tensions, downside economic risks, and the uncertainty surrounding French politics.

Last week’s data showed a moderation in the labour market and price pressures, followed up with soft retail sales data on Tuesday, suggesting that economic activity remained lacklustre in the second quarter.

The market’s immediate focus is on the U.S. weekly jobless claims data due at 1230 GMT as well as flash purchasing managers’ indexes on Friday.

“We hold a positive view for gold with a price target of $2,500 per ounce by the end of 2024,” ANZ analysts said in a note.

Spot silver rose 1.7% to $30.26 per ounce, platinum was up 0.6% at $985.81 and palladium gained 0.9% to $913.00.

News Source: Reporting by Harshit Verma and Sherin Elizabeth Varghese in Bengaluru; Editing by Mrigank Dhaniwala and Sonia Cheema. Chart image by Reuters.