Our comprehensive EC Markets review provides valuable insights you may wish to consider before trading with this leading forex broker. Enhancing your knowledge and understanding can help you make better-informed trading decisions and invest with greater confidence.

FX Trust Score Index - EC Markets

EC Markets gained an overall score of 88.25% across our five different ratings criteria.

FX Trust Score Index Ratings

EC Markets Broker Pros and Cons

- Low spreads

- Fast execution

- Multi-regulated across 7 jurisdictions

- Free and fast deposits and withdrawals

- Fast, automated KYC procedure

- Good educational resources

- Limited base currencies

*All trading involves risk. It is possible to lose all your capital.

EC Markets at a Glance

-

EC Markets Overview

-

Client Support

| Year Established | 2012 |

| Licences Held | FCA (UK), ASIC (Australia), FMA (New Zealand), FSC (Mauritius), FSA (Seychelles), FSCA (South Africa) |

| Demo Account Available | Yes |

| Base Currencies | USD |

| Promotions | No |

| Account Opening Time | Instant |

| Withdrawal Fee | None |

| Inactivity Fee | None |

| Minimum Deposit | $10 |

| Minimum Position Size | 0.01 lot |

| Maximum Leverage | Up to 1:500 |

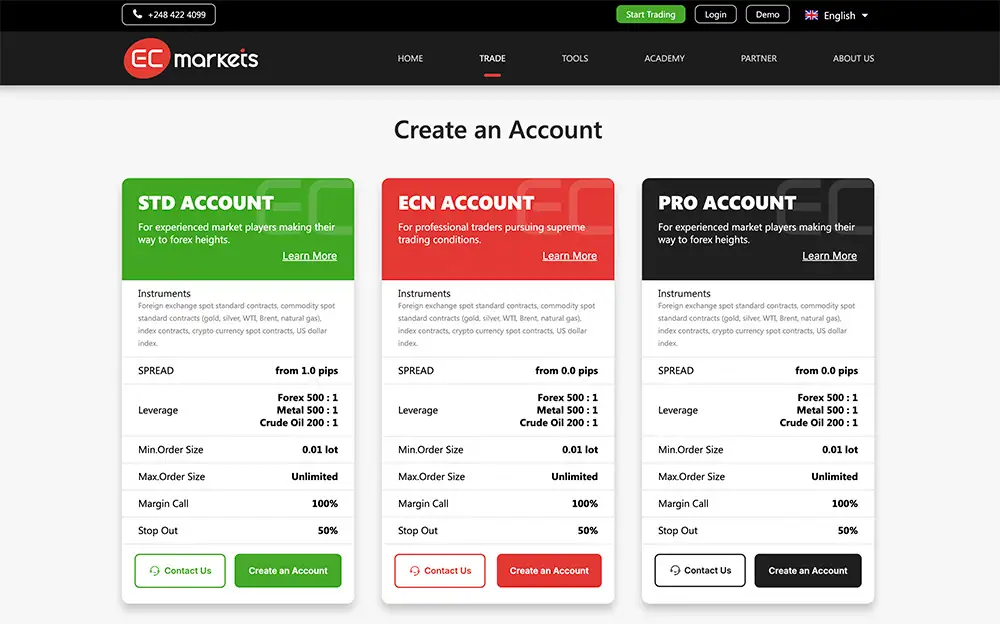

| Spread Type (Fixed/Variable) | Variable; STD account from 1.0 pips, ECN from 0.0 pips, PRO from 0.0 pips |

| Average Spread (based on EUR/USD) | 1.1 pips |

| Available Assets | CFDs on Forex, Precious Metals, Crude Oil, Indices, Cryptocurrencies |

| Number of Currency Pairs | 48 |

| Account Types | STD, ECN, PRO |

| Mobile Trading | Yes |

| 24/7 or 24/5 Trading | 24/5 (24/7 for Cryptocurrencies) |

| Hedging Allowed | Yes |

| Scalping Allowed | Yes |

| Swap Free Account | Yes |

| Languages | 22 |

| Affiliate Program | Yes |

| Free Educational Resources | Yes |

| Daily Technical Analysis | Yes |

| Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Payment Methods | |

| Deposit methods | Credit/Debit Cards, eWallets, Bank Wire, International Bank Transfer, and more |

| Withdrawal Methods | Bank Transfer, International Bank Wire, STICPAY, OTC365, Union Pay, Pembayaran Bank ATM Indonesia, Thai QR Payment, VN Pay, POLi and more |

| Withdrawal times | Within 2 hours on average |

| Withdrawal limits | Bank Transfer: $50 – $6,800 USD (Single Transaction Limit) International Bank Wire: $200-$90,000 USD (Single Transaction Limit)STICPAY: $200-$50,000 USD (Single Transaction Limit) OTC123: 50-50,000 USDT (Single Transaction Limit) |

| Currencies | Multiple currencies supported, including USD, CNY, IDR, MYR, THB, VND, INR, USDT |

| Live Chat | Phone, Email, 24/5 Multilingual Support, Live Chatbot |

| Contact Info | Phone: +248 422 4099 Email: support@ecmarkets.com |

| Social Media Channels | X (Twitter), Facebook, Instagram, LinkedIn, YouTube |

*All trading involves risk. It is possible to lose all your capital.

Is EC Markets a Trusted Forex Broker?

In this comprehensive EC Markets Review, we will be focusing on all aspects of the broker, an established forex entity in the industry with a strong reputation among traders. Our expert team has taken a closer look at how the broker ranks across a range of factors, including its regulatory licences, fund security, trading fees, educational features, online reputation, customer support, and much more. Check out our in-depth review below for a detailed overview about the broker’s full-service offering, so you can make a better-informed choice about whether to open a trading account with them.

Introduction to EC Markets: A Brief Overview

EC Markets is an established, award-winning multi-asset broker that offers top trading conditions to traders worldwide, with low fees, high-speed execution, and fast deposits and withdrawals across a number of payment methods. Founded in 2012, the company has grown to become a key player within the financial services industry, providing clients with a high-quality trading experience via its broad range of trading products.

Placing a strong focus on regulatory compliance, EC Markets ensures the safety and security of client funds through adherence to several of the world’s leading financial oversight bodies – the FCA, ASIC, and FSCA, to name just a few examples. Over the years, the company has continued to expand and evolve in order to cater to the needs of traders, with one of its key stated goals being to exceed client expectations through innovation and reliability.

Is EC Markets Safe?

Licensing and Regulation

As a multi-regulated broker, EC Markets is highly regarded within the trading community for maintaining ethical standards and best industry practices. It currently operates under licence with renowned tier-1 regulators such as the UK Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Further evidence of the broker’s strict adherence to regulatory frameworks is shown through its licences with the South Africa Financial Sector Conduct Authority (FSCA), the New Zealand Financial Markets Authority (FMA), the Financial Services Authority Seychelles (FSA), and the Financial Services Commission Mauritius (FSC). FX Trust Score has verified the validity of each of these licences and can confirm that all are active and in good standing.

Security of Funds and Protection

Transparency is at the heart of EC Markets’ operations, with the company placing client security at the top of its priorities, as demonstrated through its comprehensive list of international licences. Clients can trade safely in the knowledge that their funds are kept safe and secure as the broker implements a set of measures to ensure full security and protection. Key features include third-party auditing, negative balance protection (which protects retail clients from losing more money than they dedicated to trading), and segregated funds (whereby clients’ assets are held in separate accounts to those of EC Markets).

EC Markets Trading Platforms

EC Markets provides access to the full MetaTrader suite, made up of two of the world’s most popular trading platforms. Clients can choose between the classic MetaTrader 4 (MT4) and the next-generation MetaTrader 5 (MT5), which are both available across all devices, allowing for round-the-clock trading via desktop or on iOS and Android. The MT4 platform is renowned for its winning combination of user-friendly interface and advanced charting tools, whereas the newer MT5 offers an upgraded trading experience, packed with additional features and a wider selection of tradable instruments.

*All trading involves risk. It is possible to lose all your capital.

EC Markets Trading Assets

There is a good selection of assets for clients to trade, with more than 100 CFD trading instruments available across FX, precious metals, crude oil, indices, and cryptocurrencies. The broker allows CFD trading on silver, spot gold, Brent Crude (UK Oil), WTI (US Oil), and a wide range of leading global indices. For currency traders, there are 48 tradable currency pairs, each with varying average spreads, which include majors like EURUSD and GBPUSD and minors such as EURAUD and GBPJPY. Meanwhile, for those who prefer to trade cryptocurrency CFDs, EC Markets presents access to popular global fiat currency base pairs (BTCUSD, DOTUSD, ETHUSD, XRPUSD, and more).

Trading Conditions at EC Markets

Spreads & Commissions

Featuring extremely low spreads and competitive swap rates, EC Markets is a standout player in the financial industry for its competitive trading conditions, low fees, and a minimum deposit of just $10. On its PRO and ECN accounts, spreads start from 0.0 pips, making them well-suited to short-term trading strategies such as hedging or scalping, providing traders with reduced costs and no hidden fees embedded in the spread. As for the STD account, the rate differs per geographic region, ranging between 1.0-1.4 pips. Regarding other associated fees, commissions are charged at $3 round turn per standard lot.

Leverage

EC Markets provides traders with customisable leverage options to match their strategies and risk preferences. Offering flexible leverage between 1:100 and 1:500, users can adjust their settings at any time to better suit their specific trading goals. This flexibility improves capital efficiency while supporting strong risk management. Additionally, as a multi-licensed, trusted international broker, EC Markets strictly observes leverage limits set by some of the world’s leading regulatory bodies like the FCA in the UK and ASIC in Australia.

EC Markets Customer Support

The company’s award-winning customer service team is regarded as one of the best around, with its multilingual support agents on hand to assist 24/5. Testing of the support service on different days found a near-instant response on each occasion, with a helpful and friendly human agent offering resolutions to every query, directly addressing the issue raised with a speedy and informative answer. Aside from the live chat option, traders can also contact EC Markets online via email, while the broker’s representatives are available over the phone on local contact numbers (according to the country a client is based in).

Educational Resources for EC Markets Traders

Trader education is a key part of EC Markets’ offering, reinforcing its commitment to client growth and development. Alongside its forex glossary and economic calendar, traders of all abilities can access trading courses via the company’s dedicated ‘Academy’ website section. Meanwhile, for traders looking for expert market analysis, EC Markets’ in-house financial market analyst presents a detailed weekly overview of the most significant market movements from the previous week. Lastly, within the MT4 platform, traders can access Trading Central’s innovative set of Alpha Generation MT4 Indicators, helping them to plot directional trends and key levels directly onMetaTrader’s existing charts

EC Markets Online Reputation: What Traders are Saying

Research into online reviews about EC Markets shows that they enjoy a solid reputation within the global trading community. Overall, the feedback is very positive, with many users praising the broker’s exceptional customer service – particularly the helpfulness and responsiveness of the support representatives. Other reviewers highlighted the impressive trading conditions, including low spreads, lightning-fast execution speeds, and quick deposits and withdrawals. Reading through the user reviews, it’s clear that EC Markets has successfully built a loyal client base by consistently delivering a reliable and trader-focused experience.

How to Open an Account

Open an account with EC Markets by following these simple steps:

- Visit the homepage and click the Start Trading button.

- Complete the submission form by filling out your details in each section.

- Select GET within the ‘Verification code’ section and check your chosen email account.

- Enter your code emailed to you in the ‘Verification code’ section and click Register.

- Your account will be created and you can access the secure client area where you can create a Demo or Live trading account.

- To open a trading account, you will need to complete the ID Verification process. For any additional support, you can contact the Live Chat facility within the client area.

The FXTS Verdict: Is EC Markets a Trusted Broker?

EC Markets is a highly reputable, multi-award-winning global broker, recognised worldwide for its commitment to delivering the best possible user experience through optimised trading conditions and outstanding customer support. Licensed by a number of leading regulatory bodies across several jurisdictions – including the FCA, ASIC, and FSCA – it has a strong reputation among traders as a safe and reliable platform of choice. With its growing catalogue of educational tools and resources aimed at enhancing the knowledge of traders of all levels, EC Markets continues to make significant strides in the online trading marketplace, solidifying its position as a trusted industry leader.

*All trading involves risk. It is possible to lose all your capital.

FAQs

EC Markets is headquartered in the UK, with its main company offices situated in London. The broker also has a presence in Europe and MENA, with offices in Limassol (Cyprus) and Dubai (UAE), respectively.

Our research shows that EC Markets is a transparent, reliable, and trusted broker that is regulated worldwide by reputable authorities like the FCA (UK), ASIC (Australia), FSCA (South Africa), FMA (New Zealand), FSC (Mauritius), and the FSA (Seychelles). Strong regulatory compliance ensures that the company adheres to strict fund protection measures, including segregated accounts, regional leverage limits, and negative balance protection, among others.

The minimum deposit is $10. This low initial funding requirement makes EC Markets highly accessible to traders of all levels, allowing them to get started quickly and easily. Clients can benefit from the flexibility of a low entry point until they feel ready to deposit larger trading funds.

Depending on the jurisdiction, EC Markets offers leverage up to 1:500 on forex pairs and precious metals, and 1:200 on crude oil trading. Under its FCA and ASIC licences, leverage is capped at 1:30 for retail clients.

Each individual trader can open a total of up to 5 USD trading accounts of each type. If a client’s funds reach $20,000, they can apply for an additional account. For funds exceeding $20,000, they can apply for an additional account for every additional $5,000 deposit by contacting EC Markets’ support team.